federal income tax return

100 Free Tax Filing. Nearly all working Americans are.

The Federal Government Has Extended Federal Income Tax Deadlines Will Ohio Cleveland Com

Federal income tax is a marginal tax rate system based on an individuals income and filing status.

. These are the rates for. Dont count on getting your refund by a certain date to make major purchases or pay other financial. Federal Income Tax Brackets 2022 The taxable income rate for single filers earning up to 10275 is 10 percent and for joint married filers is 10 percent tax on income up to 20550.

E-File Directly to the IRS. Business Personal Taxes. The fast easy and 100 accurate way to file taxes online.

If both parents did not and will not file a federal tax return two Verification of Non-Filing Letters must be obtained. Efile your tax return directly to the IRS. Dont wait for things to get worse because they will.

Filing status is based on whether youre married. Ad Learn About The Common Reasons For A Tax Refund Delay And What To Do Next. Ad File Your IRS Tax Return Online for Free.

File Your Federal And State Tax Forms With TurboTax Get Every Dollar That You Deserve. Valid for 2017 personal income tax return only. Business Personal Taxes.

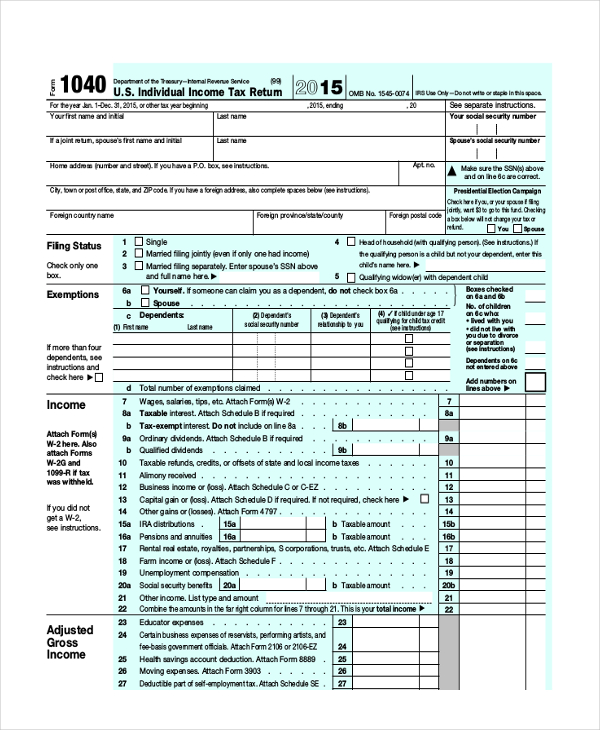

1 day agoIn 2017 Pritzker reported nearly 345 million in taxable income and paid 156 million in taxes 148 million to the federal government and 811816 to the state at a rate of 362. Your bracket depends on your taxable income and filing status. A federal tax return is a tax return you send to the IRS each year through Form 1040 US.

10 12 22 24 32 35 and 37. Type of federal return filed is based on your personal. File a Federal Income Tax Return Steps to File a Tax Return.

The divorce decree was finalized in 2018 and requires Spencer to pay alimony. He received a state income tax refund in 2021 of 3500 for state income taxes withheld in 2020. We have the largest selection at the best prices.

Home of the Free Federal Tax Return. Try it for FREE and pay only when you file. Individual Income Tax Return.

Ad Every Tax Situation Every Form - No Matter How Complicated We Have You Covered. Ad Highest Rated Tax Services. TurboTax online makes filing taxes easy.

The federal income tax consists of six. Dont wait for things to get worse because they will. Ad Foil Stamped Tax Folders Software Slip Sheet Folders Client Copy and More.

Easily Prep File Your Tax Return Online for 0. Ad Tax E-Filing to the Federal Government. Check For The Latest Updates And Resources Throughout The Tax Season.

Return must be filed January 5 - February 28 2018 at participating offices to qualify. 2021 tax preparation software. Choose your filing status.

Ad Highest Rated Tax Services. Ad See How Long It Could Take Your 2021 Tax Refund. Ad Filing Your Federal Tax Forms With TurboTax Has Never Been Easier.

For the 2021 and 2022 tax years the tax brackets are 10 12 22. Even though the original federal tax return filing deadline for most people was on April 18 this year the due date for filing an extended return for the 2021 tax year is October 17. Taxable income 87450 Effective tax rate 172.

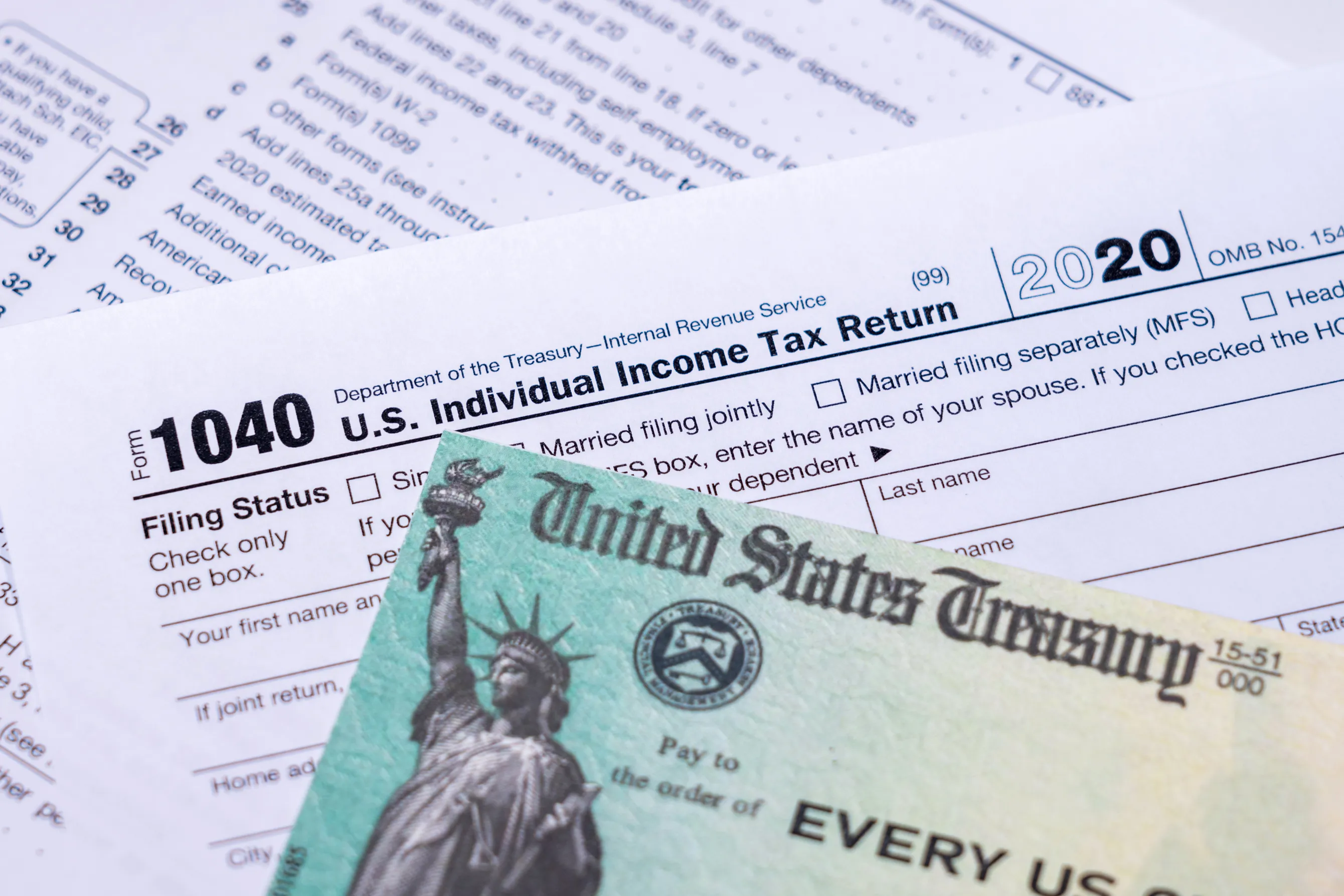

There are seven federal tax brackets for the 2021 tax year. If you filed a 2021 federal income tax return and are expecting a refund from the IRS you may want to find out the status of the refund or at least get an idea of when you might. In order to use this application your browser must be configured to accept session cookies.

Please ensure that support for session cookies is enabled in your browser. The Federal Income Tax is a marginal income tax collected by the Internal Revenue Service IRS on most types of personal and business income. It shows how much money you earned in a tax year and how.

Prepare federal and state income taxes online. If you cant find the answers to your tax questions on IRSgov we can offer you help in more than 350 languages with the support of professional. Whether you owe taxes or youre expecting a refund you can find out your tax returns status by.

If you do not have internet access call IRSs Refund Hotline at 1-800-829-1954. Using the IRS Wheres My Refund tool Viewing your IRS account information. The federal personal income tax that is administered by the Internal Revenue Service IRS is the largest source of revenue for the US.

TurboTax is the easy way to prepare your personal income taxes online. Estimate how much youll owe in federal taxes using your income deductions and credits all in just a few steps with our tax calculator. For the 2023-2024 academic year the Verification of Non-Filing Letter must.

Obama S 2012 Effective Tax Rate Was 18 4 Percent Now What Do Your Members Of Congress Pay In Taxes Don T Mess With Taxes

How To Find Out How Much You Paid In Income Taxes On Your 1040

Are You Ready To File Your 2021 Federal Income Tax Return Charlotte Center For Legal Advocacy

A Person Filing Her Federal Income Tax Return With The Single Filing Status Had A Taxable Income Of Brainly Com

Irs Publishes Q As On Filing Deadline Extension Alloy Silverstein

2014 Federal Income Tax Forms Complete Sign Print Mail

Solved According To The Irs Individuals Filing Federal Income Tax Returns Course Hero

Federal Income Tax Brackets 2012 To 2017 Novel Investor

How Do Federal Income Tax Rates Work Tax Policy Center

How Do Federal Income Tax Rates Work Tax Policy Center

When Will I Get My Federal Income Tax Refund Wise Finish

Free 9 Sample Federal Tax Forms In Pdf Ms Word

How To Track Tax Refunds And Irs Stimulus Check Status Money

Do I Need To File A Tax Return Forbes Advisor

Where Is My Tax Refund How To Check The Status After Filing Your Return Pittsburgh Post Gazette