car lease tax deduction canada calculator

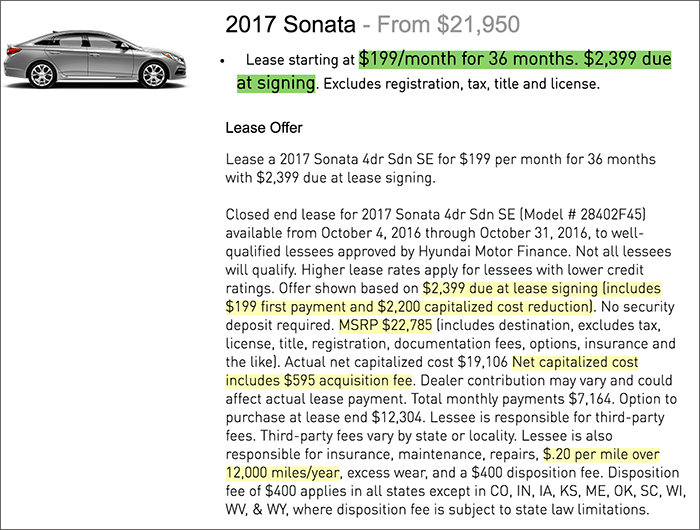

Amount comparison between interest payments on a car loan and lease payments. Leasing from a Tax Standpoint.

How To Deduct Car Lease Payments In Canada

When trading in a vehicle the final amount used to calculate the sales tax amount is lowered by the value of your trade-in.

. Starting in 2019 your deduction limit is 800 per month plus HST for your monthly lease payments giving you a maximum annual tax deduction of 9600. Enter the tax rate of any provincial sales tax PST and provincial or federal goods and services tax GST or any harmonized sales tax HST. We calculate your monthly payments and your total net cost.

When you lease a car however things are a bit different. Self-employed car loan interest and motor vehicle deductions. The amount of the deduction depends on whether its a passenger vehicle or a motor vehicle.

The business deduction is three-quarters of your actual costs or 6000 8000 075. For example if the vehicle is being used 40 to generate income then only 40 of the lease cost can be claimed. For leased vehicles the limit on the monthly lease payment that you can deduct is 800 per month plus HST which works out to a maximum of 9600 in expenses that are tax-deductible annually.

Use this calculator to find out. The ruling the CRA has on luxury cars purchased applies to depreciation. The CRA allows you to deduct the business percentage from your vehicle rental payments.

Enter the value that a dealer is giving you for your current vehicle. See Step 2 of Calculating motor vehicle expenses to find out how to deduct lease payments from your business taxes Tax benefit for zero-emission vehicles ZEVs In 2019 the CRA raised the maximum claimable CCA for ZEVs to 55000 plus the federal and provincial sales tax paid on up to 55000 of the cars purchase price. Car Leasing vs Financing Tax Benefits in Canada.

The maximum amount that the CRA will allow for lease deductions is 800. Car Lease Tax Deduction Canada Calculator. Lease Calculator Canadian Should you lease or buy your car.

You can deduct the business percentage of your lease payments. Tax benefits of leasing a car. The Automobile Benefits Online Calculator allows you to calculate the estimated automobile benefit for employees including shareholders based on the information you provide.

While the CCA offers tax relief for the overall cost of the vehicle self-employed workers and business owners can also deduct interest on car loans. For tax purposes individuals who use their vehicle to earn business income can deduct certain operating expenses for example gas and repairsmaintenance related to that vehicle. Lets say you use your.

Or more before the HST to be a luxury vehicle. When leasing a car the amount of tax deduction that can be made is directly related to its proportional use for its business to generate income. Automobile Benefits Online Calculator - Disclaimer.

A Tax Guide 2022 When employers provide automobiles to employees to help them perform their employment duties or instead give allowances or expense reimbursements the tax implications can be remarkably complex. February 2 2022 admin Uncategorized 0. More simply you can take a.

If you buy a car for business purposes in Canada you will be able to claim the Capital Cost Allowance CCA which is a vehicle depreciation deduction. That being said CCA only lets you claim part of the value of your car each year. To help this booklet provides a general outline and analysis of the relevant tax rules as they stood on February 4 2022.

Enter the total lease payments deducted for the vehicle before the tax year. Chart to calculate eligible leasing costs for passenger vehicles. Enter the total number of days the vehicle was leased in the tax year and previous years.

So the same is going to apply to the type of vehicle that you are leasing. The CRA classes any vehicle that costs 30000. The Canada Revenue Agency CRA does not keep any of the data you provide to complete your calculation.

By comparing these amounts you can determine which is the better value for you. Enter the total lease charges payable for the vehicle in the tax year. However only the business-use percentage of the vehicle qualifies for the tax deduction.

Now That I Ve Filed Bankruptcy Can I Stop Paying My Second Mortgage Or Heloc Or Home Equity Line Of Credit Rob Second Mortgage Line Of Credit Home Equity

Quickly Figure Out If Your Lease Deal Is Good

Leasing A Car Through Your Business In Canada Loans Canada

Is It Better To Lease Or Buy A Car For A Business In Canada

Is It Better To Buy Or Lease A Car Taxact Blog

Is It Better To Buy Or Lease A Car Taxact Blog

Best Balanced Mutual Fund Schemes Equity Oriented Review Mutuals Funds Investing Money Fund

Should I Buy Or Lease My New Business Vehicle 2022 Turbotax Canada Tips

Is It Better To Buy Or Lease A Car Taxact Blog

How Car Lease Payments Are Calculated The Canada Car Buying Guide

Car Expenses What You Can And Cannot Claim As Tax Deductions

Is It Better To Buy Or Lease A Car Taxact Blog

Is It Better To Buy Or Lease A Car Taxact Blog

Is It Better To Lease Or Buy A Car For A Business In Canada

Is Your Car Lease A Tax Write Off A Guide For Freelancers

Kalfa Law How To Calculate Tax Deductions For Vehicle Expenses

Is Your Car Lease A Tax Write Off A Guide For Freelancers

How To Make The Most Of Work Vehicle Expenses On Your Tax Return Cbc News